Best Debt Repayment Strategies 2026: Snowball vs Avalanche vs Cash Flow Index Explained

Updated December 2025 – Discover which debt payoff method saves you the most money and time

Stay motivated on your journey to becoming debt-free

If you're juggling multiple debts like credit cards, student loans, and car payments in 2025, deciding which one to pay off first can feel overwhelming. A quick Google search for "best debt repayment strategy 2026" or "how to pay off debt fast" almost always brings up the debt snowball method first. But is it really the best? In this in-depth guide, we'll compare three proven strategies: the Debt Snowball, Debt Avalanche, and Cash Flow Index. You'll see real examples, pros and cons, and how to choose the right one for your situation.

The Core Principles All Debt Payoff Strategies Share

All three methods follow the same foundational rules:

- Pay minimums on everything – Never miss a minimum payment to avoid fees and credit damage.

- Throw extra money at one debt – Focus your additional payments on a single target debt.

- Roll over payments – When one debt is gone, add its former payment to the next target for growing momentum.

1. The Debt Snowball Method: Motivation Through Quick Wins

Popularized by Dave Ramsey, the debt snowball ignores interest rates and pays debts from the smallest balance to the largest. The goal? Quick psychological wins to keep you motivated.

Visual explanation of the Debt Snowball Method (Source: Ramsey Solutions)

Pros: High motivation, simple to follow, backed by behavioral psychology.

Cons: You may pay more interest overall.

2. The Debt Avalanche Method: Save the Most on Interest

The avalanche attacks debts by the highest interest rate first. It's the mathematically optimal way to minimize total interest paid.

:max_bytes(150000):strip_icc()/debt-avalanche-vs-debt-snowball-which-best-you.asp_v1-b62b7fef4c6949aa96550aa2c33b391e.png)

Debt Avalanche vs Snowball side-by-side comparison (Source: Investopedia)

Pros: Saves the most money, often fastest overall payoff.

Cons: Slower initial progress can feel discouraging.

3. The Cash Flow Index Method: Free Up Monthly Cash Fast

The lesser-known Cash Flow Index (CFI) calculates efficiency: Balance ÷ Minimum Payment. Lower CFI = pay this debt first to quickly improve your monthly cash flow.

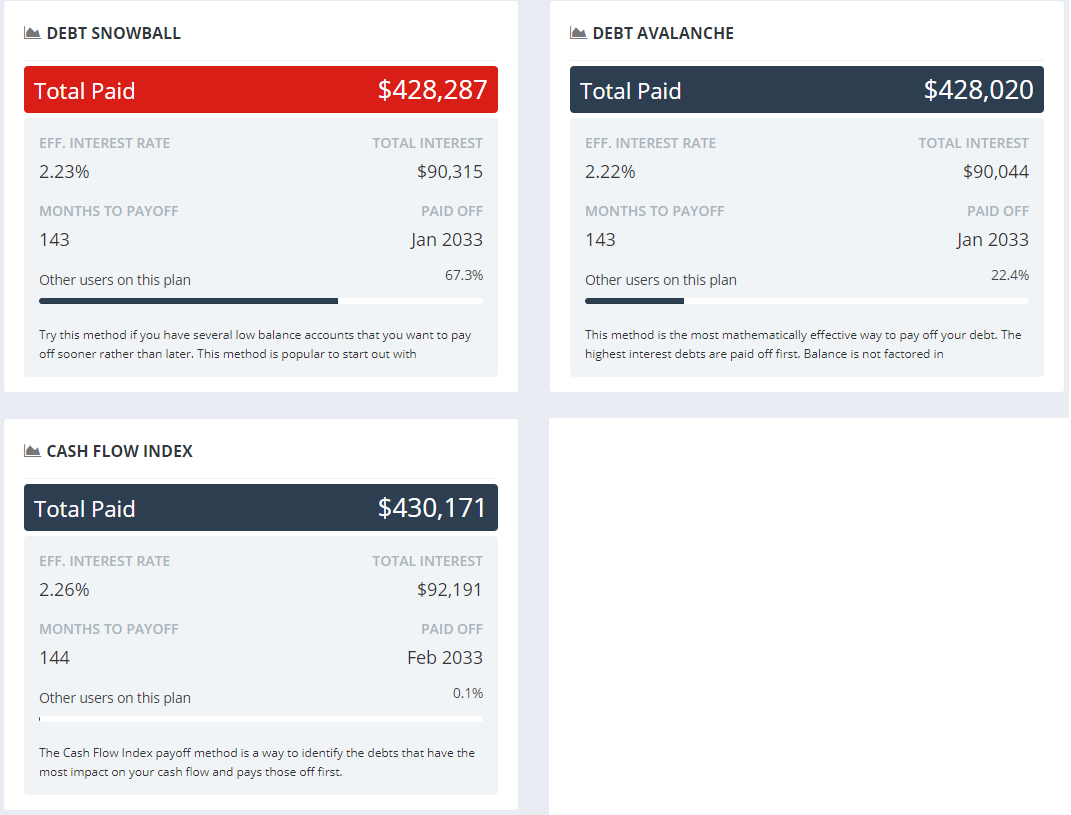

Cash Flow Index method example and comparison (Source: Undebt.it)

Pros: Rapidly increases available cash each month.

Cons: May cost slightly more in interest than the avalanche.

Real Example: Your Debts Compared Across All Three Strategies

Common types of consumer debt that many people face

Debts:

- Credit Card A: $1,500 balance, 18% APR, $75 minimum

- Car Loan C: $3,000 balance, 8% APR, $120 minimum

- Student Loan B: $7,000 balance, 5% APR, $300 minimum

With $200 extra per month:

| Strategy | Order | Time to Pay Off | Approx. Interest Paid |

|---|---|---|---|

| Snowball | A → C → B | ~18 months | ~$577 |

| Avalanche | A → C → B | ~18 months | ~$577 (lowest interest) |

| Cash Flow Index | A → B → C | ~18 months | ~$604 |

Which Debt Payoff Strategy Is Best in 2026?

- Need motivation? → Debt Snowball

- Want to save maximum money? → Debt Avalanche

- Need more cash flow quickly? → Cash Flow Index

Tips to Pay Off Debt Even Faster

- Build a budget and find extra money

- Negotiate lower interest rates

- Increase income with a side hustle

- Celebrate milestones

The ultimate goal: Financial freedom and celebrating being debt-free!

Start Your Debt-Free Journey Today

Pick one strategy, run the numbers for your own debts, and take the first extra payment this month. You've got this!

Comment below: Which strategy are you starting with in 2026 – Snowball, Avalanche, or Cash Flow Index?